Read the Full Zoopla report

Rental market report: what's happening to rents?

29 March 2023

Executive Director - Research

When will the cost of renting start to slow and will landlords need to reduce rents in the future? Our Executive Director of Research, Richard Donnell, looks into the rental market.

Key takeaways

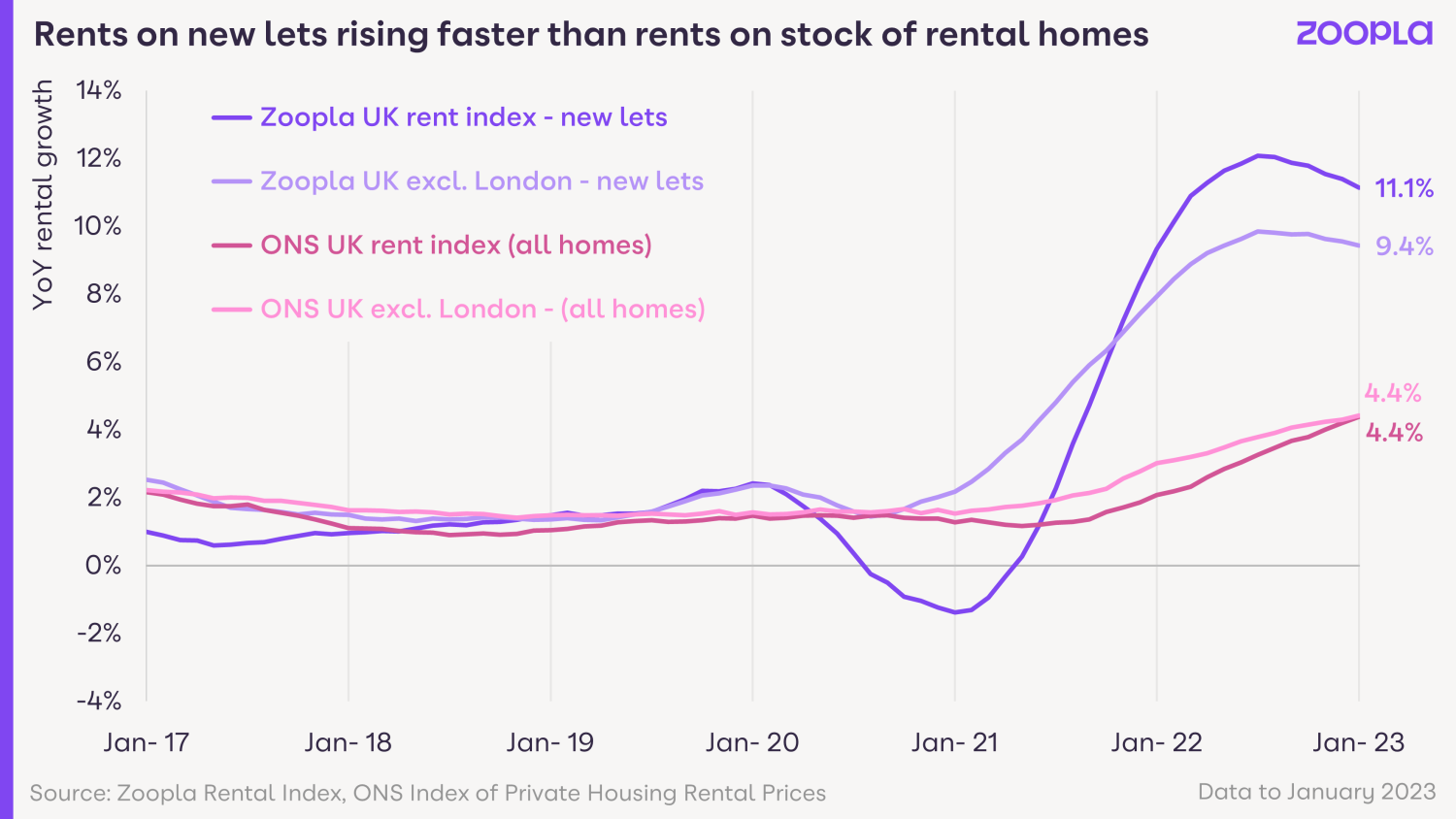

Rental inflation has slowed to 11.1%, from a high of 12.3% in mid-2022

A strong labour market and record immigration drove demand in 2022. Private rented housing supply has grown just 1% since 2016

Higher mortgage rates have further weakened the economics of investing for landlords, impacting new investment in rental supply

Landlords ‘searching for yield’ to offset rising costs will push some to let into different sectors of the private rental market

The growth in overall rental supply is set to remain limited in 2023. Demand is expected to remain above average but lower than 2022

Rental inflation for new lets will slow to 4-5% by the year end. The slowdown could be rapid in inner London and other city centres

The residential rental market has been running hot for 2 years, with something of a perpetual boom in residential rents which continue to run well ahead of earnings growth.

Average rents for new-lets have increased by 11.1% in the last 12 months while earnings had increased by 6.7%1. Rental inflation has slowed slightly from 12.3% in mid-2022 but there is no sign of any imminent slowdown.

Rents have risen by 20% in 3 years - an extra £2,220 a year - which is an ongoing concern for renters, especially those on lower incomes and/or in receipt of housing benefit.

This report takes a detailed look beneath the headlines into what is driving the boom in rental demand and why we are not seeing a supply-side response.

The key questions are:

1. When will we see rental growth slow?

2. Is there a risk the rapid rise in rents means landlords over-shoot and need to recorrect in future?

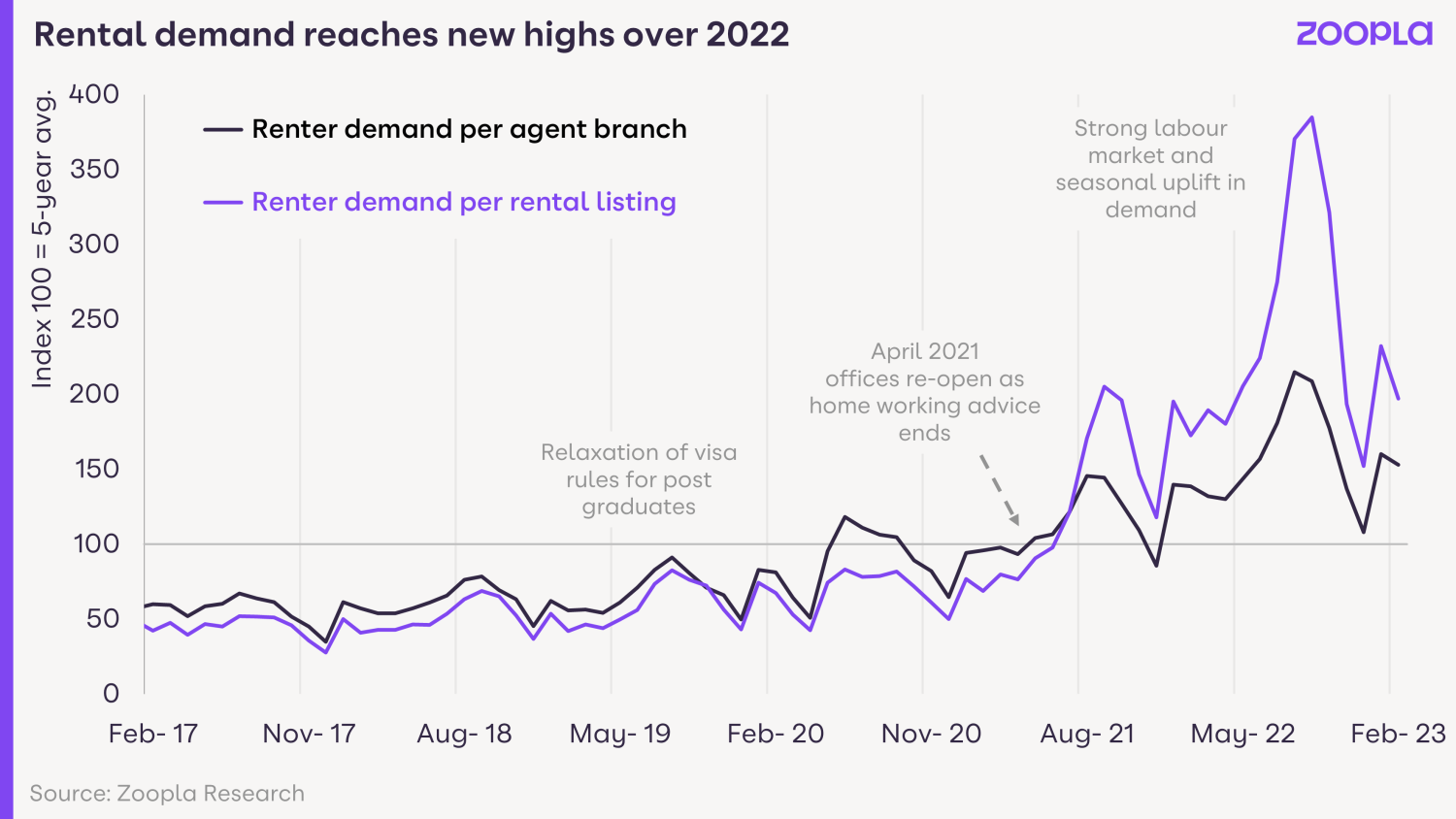

Demand for rented homes, and rental inflation, took off as the economy reopened in the spring of 2021 and new visa rules attracted a major inflow of students and others for work.

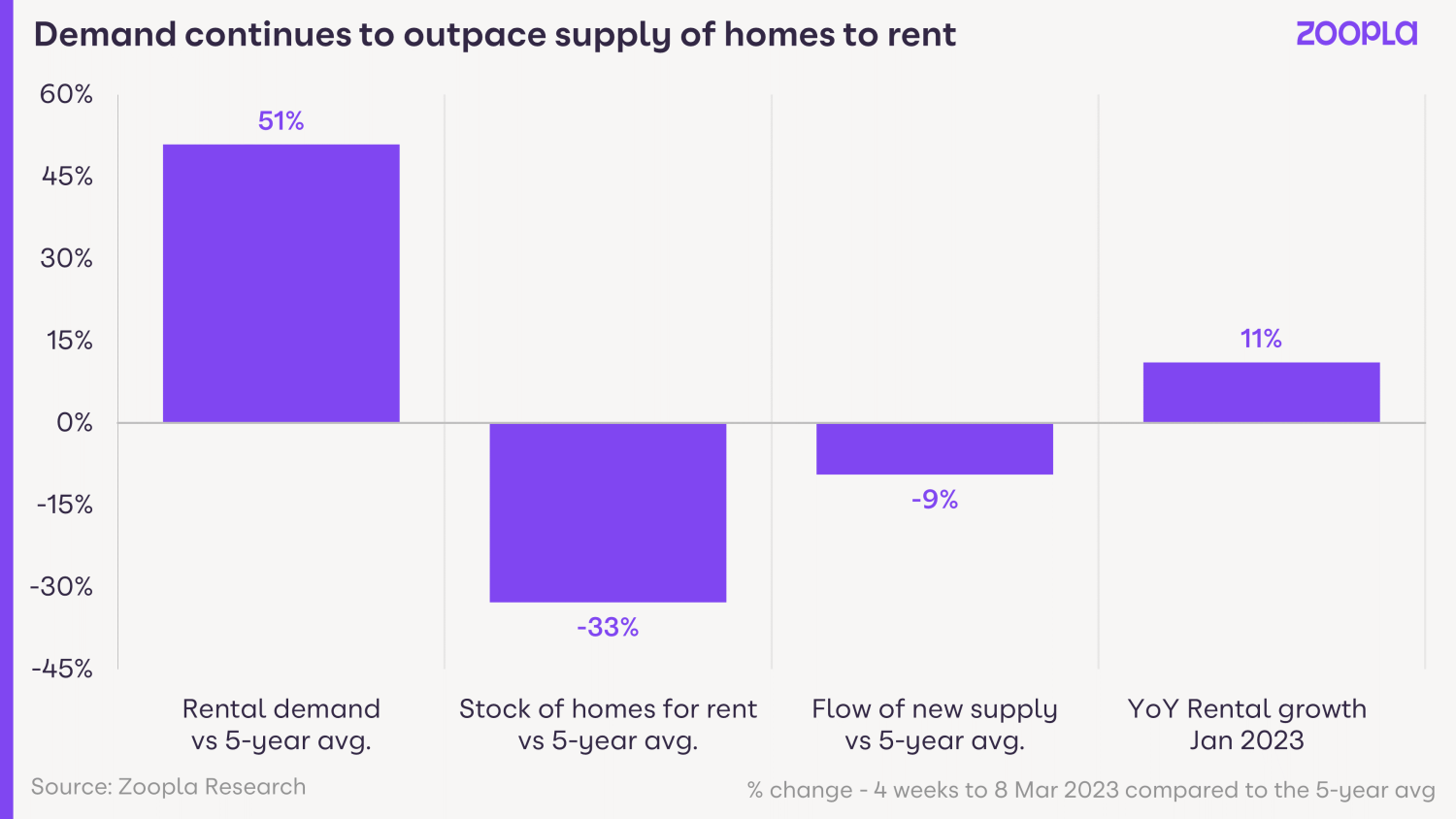

Our core measure of rental demand - enquiries received per estate agency branch - peaked in summer 2022 at double the 5-year average.

However, with a third fewer homes available for rent than normal, demand per available rental home spiked even higher last year by 250% above the 5-year average.

Demand for rented homes remains 10% higher than this time last year. Rents will continue to rise ahead of incomes unless we see a sustained increase in rental supply or a material weakening in demand, both of which appear unlikely at this stage.

The underlying driver of rental demand is the strength of the jobs market which has been strong and where there are over 1m vacancies according to the latest ONS data.

Many jobs are filled by UK nationals, ut the world’s advanced economies are increasingly looking to immigration to fill jobs, particularly highly skilled workers.

In early 2021, the UK government conducted a major shake-up of visa rules to attract skilled talent. This was one of the drivers of record high net immigration totaling 504,000 people in the year to June 2022.

This was boosted by humanitarian schemes supporting Ukrainians fleeing the war and a specific visa scheme for British Overseas citizens looking to leave Hong Kong and move to the UK.

A jump in student numbers also boosted migration. Overseas students studying in the UK totaled 680,000 in 2021/22, up 122,000 in 2 years thanks to new visa rules.

This group are a lucrative market for universities and part of the strategy to attract talent to the UK.

All university towns have sizable amounts of purpose-built student accommodation (PBSA). But there is a widely reported supply/demand imbalance for PBSA due to the growth in student numbers.

This means student demand will spill over into the wider rental market, boosting rental demand in the summer months, which was particularly strong in 2022 as international borders continued to re-open.

This explains why rental inflation has remained strong across major UK cities.

While demand has increased, the number of privately rented homes remains largely static. In 2021, there were 5.5m private rented homes in Great Britain - slightly more than the 5.4m total in 2016.

This follows a doubling in the number of private rented homes between 2002 and 2015, driven by landlords using buy-to-let mortgages.

In simple terms, a static supply of rented housing means new investment that adds to supply is offset by property leaving the sector, as landlords dispose of rented homes as part of ongoing portfolio rationalisation or exit the rental market altogether.

We are registering a slight slowdown in landlord sales in the face of a weaker sales market. Some 11% of homes listed for sale on Zoopla in early 2023 were formerly rented. This is a reduction from over 13% last year but levels remain above average.

Tax changes, growing regulation and higher borrowing costs are leading many private landlords to review their portfolios and the pros and cons of investing in housing.

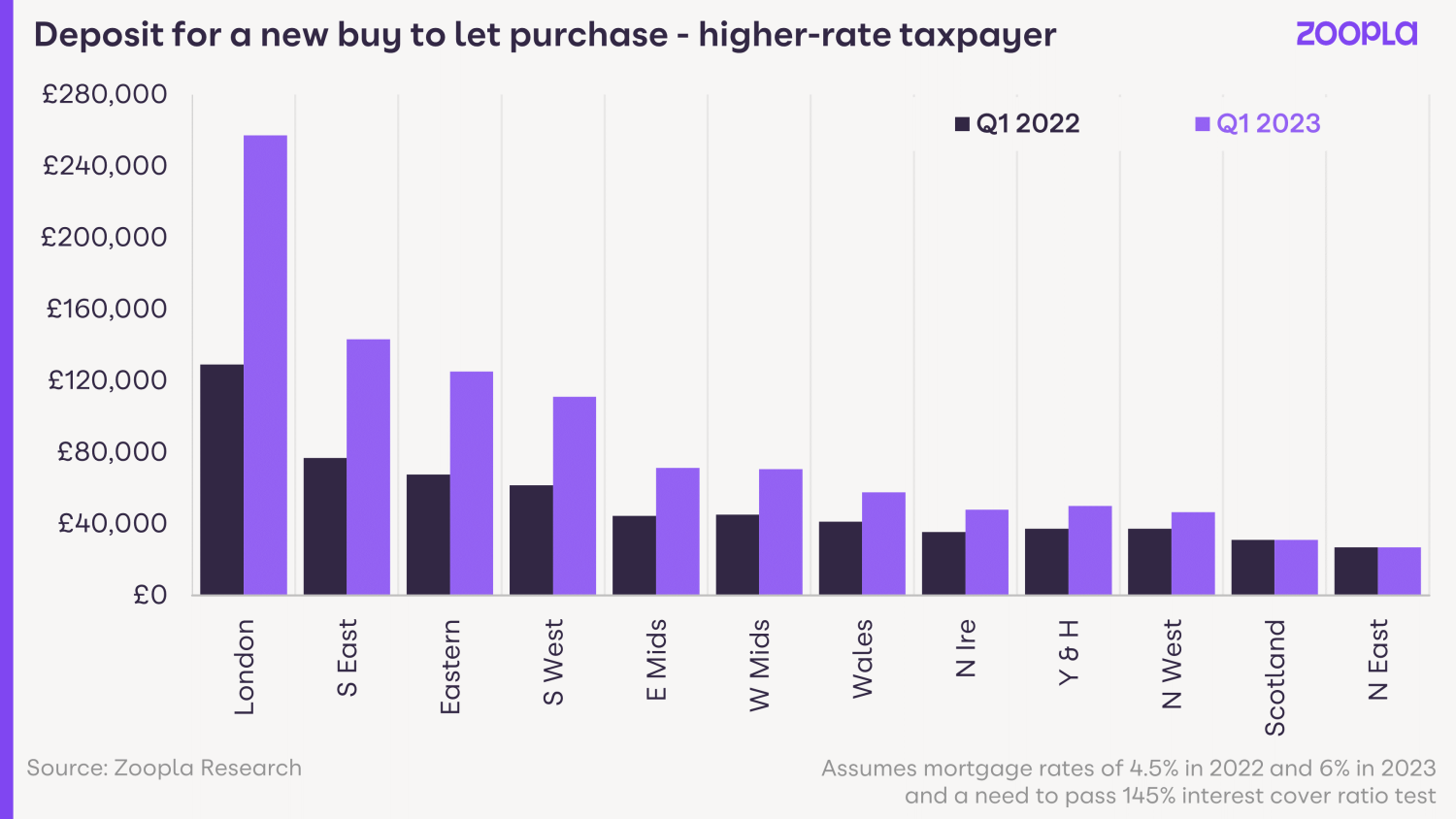

The equity needed to buy new rented homes with a mortgage has been increasing in recent years as a result of rising house prices, lower rental yields and tighter lending criteria. This has been exacerbated over the last six months by rising mortgage rates.

Buy-to-let mortgages are generally interest only. Lenders require the rental income generated by a property to be at least 125% of the mortgage interest payments for lower-rate taxpayers.

This increases to 145% for higher-rate taxpayers, reflecting tax changes made in 2016.

Today, banks are stress testing the affordability of new buy-to let loans using a ‘stress rate’ of c.6% , compared to c.4.5% a year ago.

This chart shows the amount of equity (deposit) needed to buy a typical rented home for a higher rate taxpayer and how higher mortgage rates have pushed this higher over the last year. It will be a similar profile for lower rate tax-payers albeit at slightly lower values.

In London, the equity needed to invest has jumped from £129,000 to over £257,000 - or 50% of the property value. This is a sizable deposit to buy a property delivering a gross rental yield of just 4%.

The level of equity to buy remains lower in regional markets where rental yields are higher - in most cases a higher rate taxpayer will need to take a 60-70% loan to value mortgage.

The changing economics of buy-to-let, taken together with rising costs, more regulation and the uncertain outlook for property values is severely limiting the level of new investment by private landlords.

Some landlords are shifting portfolios into limited companies to find tax efficiencies, but this isn’t an option for all landlords.

Those that continue to invest will be focusing on buying lower value homes with higher rental yields or looking at segments of the rental market that deliver higher revenues and stronger cashflow potential.

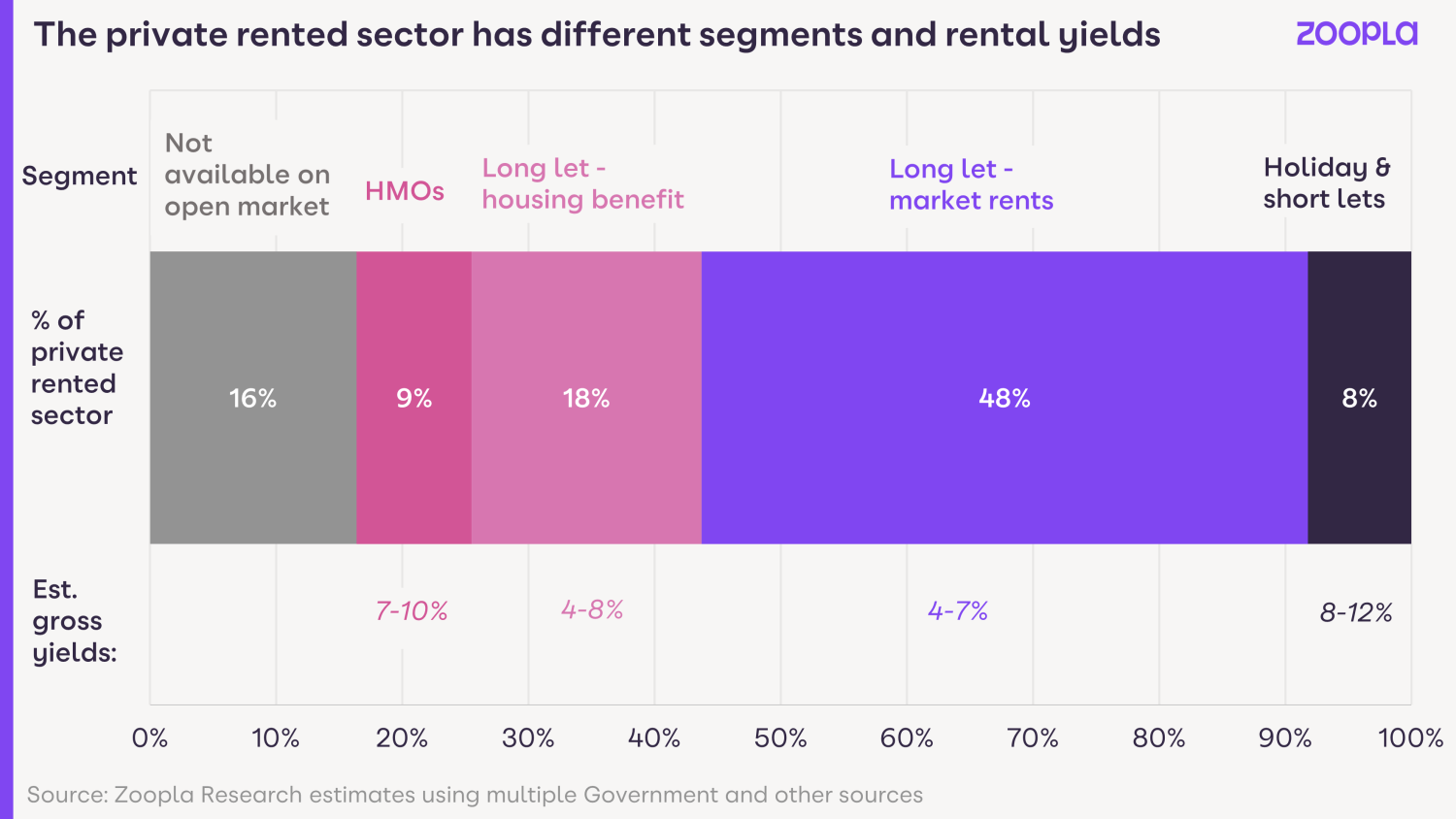

To help illustrate the choices facing landlords, the chart below shows our estimates on how the private rental market breaks down by subsector nationally. This profile will vary widely at a local level.

1) c.1m homes are not available on the open market e.g. they are rented as part of a job or let under secure long-term tenancies.

2) We estimate up to 8% of rented homes are operating in the holiday / short let sector where revenues are higher but so are running costs. Concentrated in cities and tourist hotspots, there is a risk that the availability of homes for rent in the long-let market will be squeezed if landlords shift into this sector for better returns.

3) HMOs (houses in multiple occupation) are single dwellings where people rent a room and share other facilities - these are subject to local licensing schemes and incur higher management costs, but revenues and yields are higher than a typical buy-to-let property.

4) The ‘core’ private rented sector is the long-let market where renters pay an open market rent and take initial tenancies of 6-12 months. Rental yields are lower in this segment, but it delivers almost half of all rental supply. It is an important tenure to support economic growth and mobility in the labour market.

5) Within the long-let market c25% of renters are in receipt of housing benefit. Rents are set by the Government - at the low end of the market - and have been frozen since 2020. Yields are similar to the open market assuming landlords buy lower value homes.

Landlords facing cost and regulatory pressures have some choices other than selling. In most cases planning permission is not required to change between segments. In a sector where overall supply is static, small shifts within these segments can compound supply side pressures, especially in local markets.

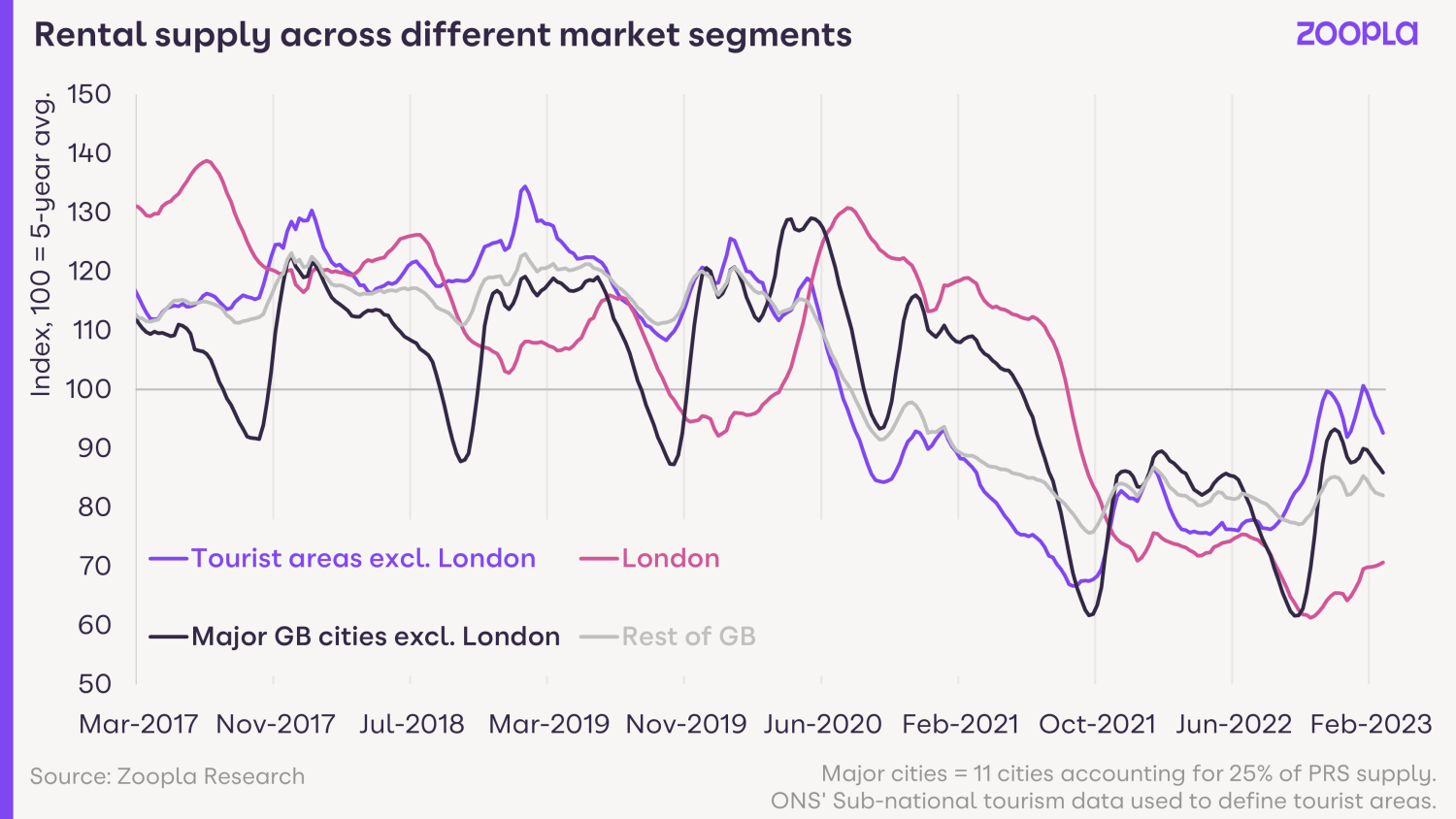

There are also different patterns in the availability of rented homes by type of area whether tourist hotspot, city or London. The chart shows that the number of homes for rent is below average in all types of area, reflecting the national trend.

The availability of homes for rent is worst in London where there is huge competition from a range of renters including students, those working in London and short term visitors. London also has the lowest rental yields rental in the UK.

We have shown how much equity is needed by private landlords to invest in this market which limits the flow of new supply to improve availability. The net result is that London tops the league tables for rental inflation at 15.2%.

Supply has improved in tourist areas which are out of season at present. This might also reflect more supply that was holiday/short lets moving into the long let market as the ‘staycation’ boom slows.

Available rental supply has also improved in major UK cities - the largest 11 excluding London. This is the most seasonal line, reflecting the ebb and flow of student demand each summer. There is also significant corporate investment in so called ‘build to rent’ schemes across many UK cities, which is steadily adding to supply in city centres, although overall city availability remains below average.

Low supply exacerbates rental growth. In local areas where rents for new lets have jumped the most, there is a risk that rents may over-shoot sustainable levels.

If rents get so high that many existing renters in an area simply couldn’t afford them and demand were to cool or supply improve, the rental level would need to reset lower.

This would result in a sharp slowdown in growth rates. The greatest risk is in inner London where affordability is stretched.

There is a difference between the pace at which rents are rising for new lets, when a property becomes vacant and the rent resets to the market rate, and how much rents are rising across the whole rental market, whether people are moving or not.

Both matter to renters as they impact the decision whether to move to a new property or how much their landlord might increase the rent after the initial term.

Higher growth in new lets, measured by the Zoopla rental index, leads the whole market growth rate, tracked by the ONS index.

We expect a continued scarcity of homes for rent over 2023 given the weaker economics for investors. Ongoing completions of build to rent schemes will be one bright spot, adding supply at the mid to upper end of the market across UK cities.

One additional area of potential supply could come from sellers renting out homes they can’t sell due to a weaker sales market, but conditions aren’t sufficiently challenging at this stage for this to impact the outlook.

Rental demand is unlikely to be quite as strong as last year given weaker economic growth, but we expect it to remain above the 5-year average.

Much depends on trends in employment, especially across UK cities where rented homes and jobs are concentrated.

In terms of affordability, average rents expressed as a percentage of earnings are now at or close to ten-year highs in all regions except London. This will start to impact the pace of rental growth over 2023, which we expect to slow to 4-5% by the year end.

A faster slowdown in rents in inner London and some inner-city areas could develop later this year as stretched affordability combines with localised increases in supply and slower jobs growth.